GRC Sphere

Enterprise Banking Governance, Risk & Compliance Platform

AI-powered compliance automation across Basel III, IFRS 9, AML/CFT, and ESG monitoring everything, automating the tedious, predicting the risks you haven't seen yet.

End the spreadsheet era for banking. Purpose-built for financial institutions seeking comprehensive governance, risk, and compliance management.

Deploy in hours. Get 70% of your time back. Give your board the clarity they've been asking for.

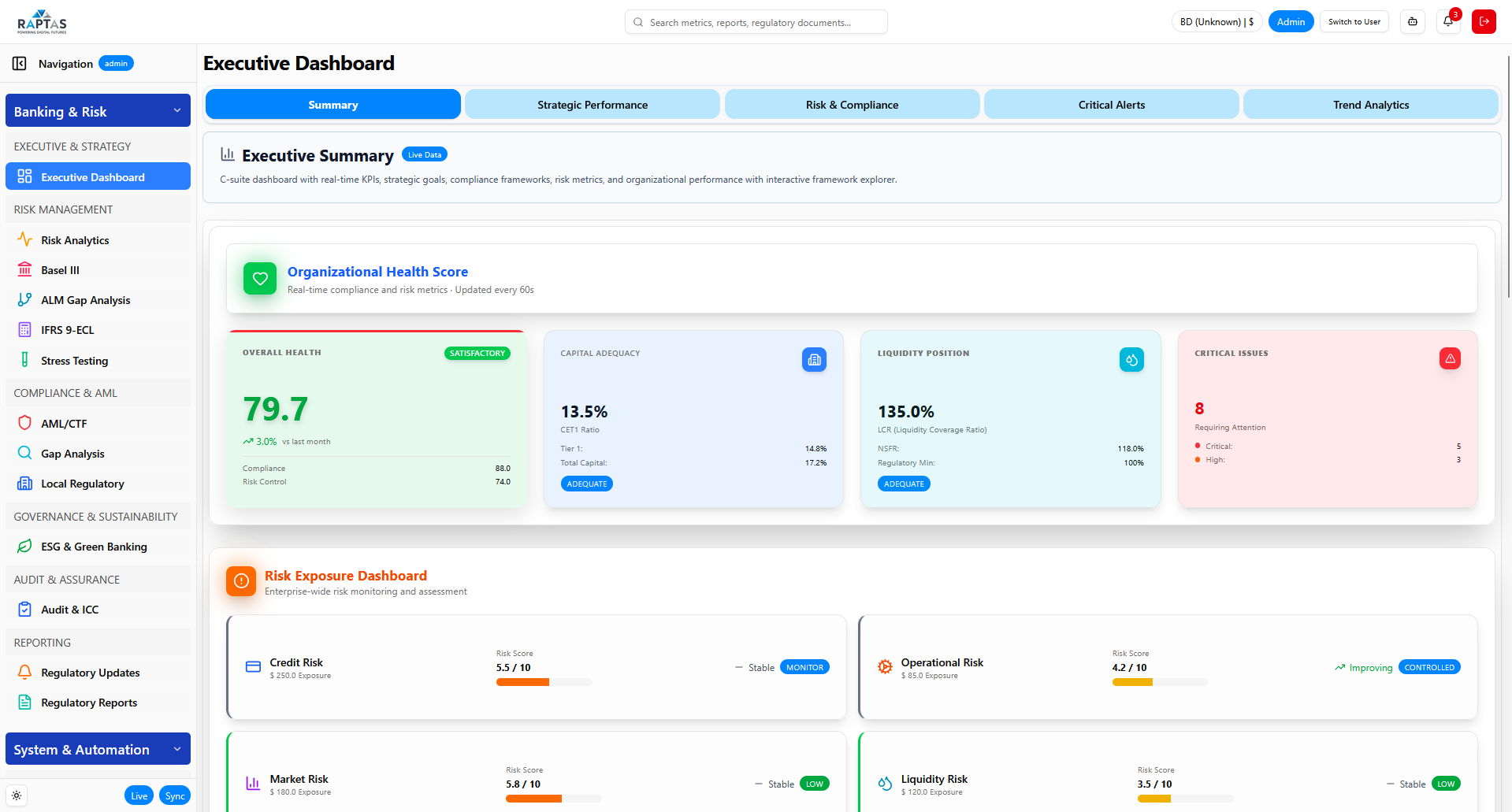

Executive Dashboard

Core Modules

GRC Sphere platform is organized into three pillars – Risk Management, Compliance and Governance. Each module has all the core functions of risk, compliance and governance.

Executive Command Center

Brings together high-impact KPIs, risk posture, and strategic execution into a single live view for CXOs. Helps leadership monitor capital, liquidity, compliance, and performance with clarity and control.

Key Capabilities

Real-time organizational health score with CET1, Tier 1, Total Capital ratios, LCR, NSFR tracking and 60-second data refresh

Strategic capital allocation by pillar with budget distribution, deployment tracking, ROI targets, and initiatives pipeline monitoring

Enterprise risk scoring across credit, market, operational, liquidity, compliance, reputational with real-time alert monitoring and severity prioritization

Risk & Gap Analysis

Comprehensive risk intelligence and benchmarking suite for capital, liquidity, compliance, and peer comparison across global regulatory frameworks with real-time insights and predictive analytics.

Key Capabilities

Real-time portfolio monitoring with AI-powered credit scoring, 30-day risk forecasting, automated breach detection, VaR, CVaR, and Sharpe ratio calculations

Basel III capital adequacy tracking with CET1, Tier 1, Total Capital, Leverage Ratio, RWA analysis, buffer management, and capital optimization

LCR/NSFR calculation with HQLA composition, 30-day cash flow projections, intraday liquidity monitoring, and G-SIB systemic importance mapping with benchmark gap analysis

Basel III & IV

Comprehensive compliance suite covering capital adequacy, liquidity, leverage, stress testing, and regulatory reporting with Basel IV output floor analysis and standardized approach implementation tracking.

Key Capabilities

Consolidated compliance overview with capital ratios, liquidity metrics, leverage analysis, Basel IV output floor impact, and real-time regulatory tracking

Capital structure breakdown with CET1, Tier 1, Total Capital, conservation buffers, systemic risk buffers, and Basel IV enhanced SA analysis

Portfolio data management with CBS integration, customers/exposures workflow, automated RWA calculations, and Basel IV risk distribution across credit, market, operational

IFRS 9-ECL – Assessments and Calculation Platform

Enterprise-grade expected credit loss assessment framework with ML-powered predictions, multi-country regulatory alignment, and comprehensive governance—delivering auditable, mathematically-validated provisions across all portfolio segments.

Key Capabilities

End-to-end assessment with multi-indicator SICR engine combining 22 behavioural/financial/macro triggers, scenario-based recovery modeling, DPD trend analytics, NRV collateral assessment with forced sale haircuts, and automated compliance validation

Real-time ECL calculations with automated stage 1/2/3 classification, model-driven PD×LGD×EAD provisioning, Model Studio with calibration workflows, parametric calculation engine supporting portfolio/single-loan modes, and AUC/Gini performance metrics

Multi-level declassification approval routing across branch/HO/MD/CEO/board, country-specific compliance supporting dual IFRS 9 and local regulatory standards, mathematical engine with stage-specific calculations, and complete audit trail

Stress Testing

70+ stress models simulating adverse scenarios across capital, liquidity, and credit risk to assess resilience, regulatory readiness, and portfolio vulnerabilities with configurable parameters and real-time compliance validation.

Key Capabilities

Comprehensive KPI monitoring with quick-action scenario execution, configurable GDP/inflation/unemployment/interest rates/credit growth parameters, and historical calibration

Sector exposure analysis with credit rating migration modeling, concentration risk assessment, Herfindahl Index calculations, and real-time portfolio comparison modes

3-year capital ratio projections under baseline/adverse/severe scenarios with CET1, Tier 1, Total Capital tracking, LCR/NSFR stress testing, and regulatory submissions with 94% on-time performance

AML/CTF

Real-time surveillance and compliance suite for anti-money laundering and counter-terrorism financing with unified command center for alerts, STRs, sanctions, and transaction intelligence featuring 82-factor risk engine and ML-driven pattern detection.

Key Capabilities

Unified command center with real-time STRs, sanctions hits, suspicious activity breakdown, 82-factor risk engine across 8 categories with ML calibration, and KYC compliance monitoring

Real-time screening against OFAC, UN, EU, UK, Bangladesh Bank, FATF sanctions with PEP database, adverse media monitoring, and automated match detection

Force-directed graph visualization with entity relationships, auto-clustering by risk similarity, geospatial analysis, 2-hop transaction mapping, and case workflow from investigation through STR filing

ALM Gap Analysis

Interest rate risk gap analysis with shock scenarios, NII/EVE impact, and regulatory limit monitoring featuring run management with rate-sensitive bucket classification and parallel/non-parallel shock scenario execution.

Key Capabilities

Run configuration management with monthly/quarterly/ad-hoc types, as-of date snapshots, approval status tracking, total assets/liabilities, cumulative gap, and duration gap calculations

Shock scenario library with parallel shift up/down scenarios, basis point magnitude, direction specification, regulatory/internal designation, and multi-scenario execution capabilities

NII/EVE delta calculation with scenario-based income impact, basis point value sensitivity, automatic regulatory limit breach detection, and gap ratio analytics with duration gap quantification

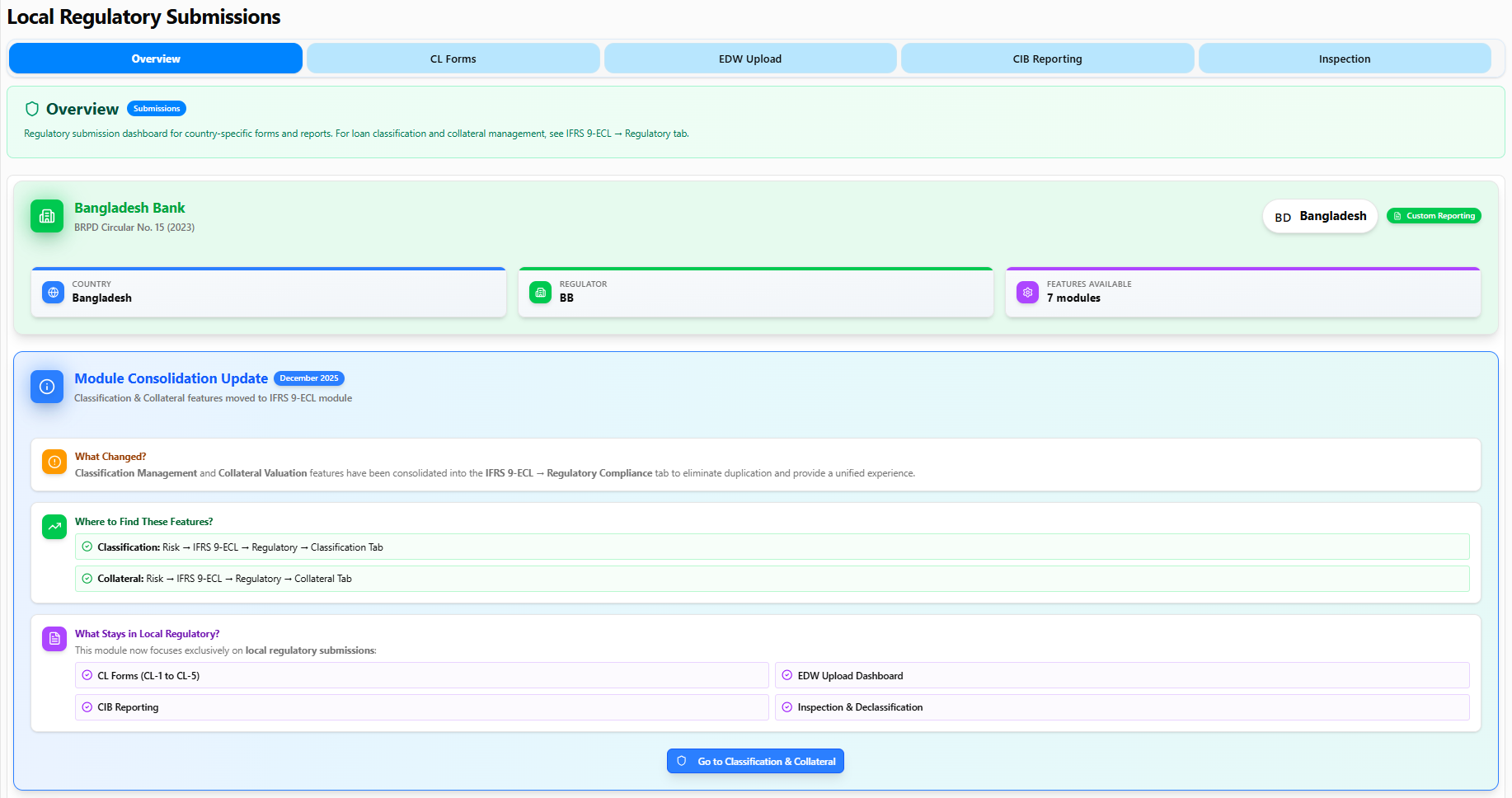

Local Regulatory Submissions

Country-specific compliance module for managing jurisdictional regulatory frameworks with centralized hub for central bank regulatory submissions, inspection readiness, CL Forms generation, EDW upload, and CIB reporting workflows.

Key Capabilities

CL Forms repository with pre-configured templates for BRPD, DOS, and inspection forms, submission tracker monitoring due dates, status, and responsible units

EDW upload interface with FTP/SFTP options for scheduling reports/CL Forms directly to central bank, validated dataset push with audit trail and format compliance

CIB reporting with borrower sync, auto-map loan data to CIB format with validation, reporting workflow tracking submission status and error resolution

ESG & Green Banking

Turns sustainability into strategy by tracking environmental impact, social inclusion, and governance strength while aligning portfolios with green taxonomies and climate goals—from carbon metrics to SDG contributions.

Key Capabilities

ESG performance scoring with environmental/social/governance pillar calculation, carbon footprint quantification, renewable energy percentage, paperless transaction adoption, and waste reduction metrics

Multi-scope carbon accounting (Scope 1/2/3), sustainable investment tracking with CO2 reduction, green bond value, taxonomy alignment with sector breakdown, and green lending portfolio

Physical and transition climate risk analysis, finance emissions (PCAF), PCAF data quality tracking, 17 UN SDG contribution calculation, and NGFS scenario stress testing

Audit & ICC

Consolidated internal controls and audit dashboard with risk-based audit plan execution, control effectiveness metrics, finding status, remediation progress, and AI-powered executive insights featuring ML-powered audit universe and workflow automation.

Key Capabilities

Consolidated ICC overview with risk-based audit execution, control effectiveness metrics, compliance score trends, AI-powered executive insights, and critical findings alerts

ML-powered audit universe with risk-based entity rankings, quarterly coverage tracking, centralized findings repository with severity classification, CRUD operations, and status workflow

Visual drag-and-drop workflow designer with real-time SLA monitoring, ICAAP framework with board oversight, CET1 capital tracking, ILAAP dashboard with LCR/NSFR, and 25+ regulatory frameworks

Regulatory Updates

Centralized module for tracking, assessing, and implementing regulatory circulars issued by central banks and financial authorities with circular tracking dashboard, impact assessment engine, and deadline management calendar.

Key Capabilities

Circular tracking dashboard monitoring issuance, deadlines, and status filtered by priority, impact, and category with quantified operational/financial/tech impact scoring

Deadline management calendar tracking overdue, upcoming, and critical tasks with progress visualization, owner assignment, change management workflow automating regulatory implementation steps

Departmental impact mapping identifying affected teams, dependencies, ownership, training needs, compliance risk categorization by AML/ESG/Data Privacy, and policy recommendation engine

Regulatory Reports

Centralized hub for managing regulatory submissions, templates, workflows, and jurisdiction-specific compliance tracking with full audit visibility featuring report catalog, workflow tracking, and configuration management.

Key Capabilities

Overview snapshot providing compliance status summary tracking active reports, compliance rate, upcoming deadlines, jurisdictional scope, and regulatory authority metrics

Report catalog template library for financial, risk, and compliance reports organized by category and priority with quick selection, preview, and categorized browsing

Workflow lifecycle monitoring from preparation to final approval with submission progress tracking, role-based assignment, timestamps, jurisdiction settings, and auto-generation scheduling

ML Analytics

AI-powered workflow intelligence module that detects bottlenecks, predicts SLA risks, and optimizes performance across compliance and audit processes using machine learning for high-level performance and compliance visibility.

Key Capabilities

Executive summary highlighting workflow risk score, SLA compliance percentage, anomaly detection count, and ML-driven strategic insights for decision-making

Strategic performance tracking with workflow efficiency metrics, completion rates, delivery trends, and performance distribution visualization across workflow types and priorities

ML-generated critical alerts for SLA breaches and bottlenecks with recommended actions, historical trend analysis, and predictive analytics for performance forecasting

Administration

Centralizes control over organizational identity, user access, workflow automation, and system-wide configurations empowering teams to manage branding, assign roles, orchestrate GRC tasks, and configure alerts and integrations.

Key Capabilities

Organization and branding setup configuring legal, tax, and registration details with identity management across system interfaces and operational consistency

User and roles management assigning roles and access by department, tracking login history, user status, access request handling, and secure access control

Workflow automation center orchestrating GRC tasks with routing and audit trail, system configuration for alerts, APIs, monitoring tools, email, SMS, file settings, and risk parameter management

Key Platform Benefits

Built for modern financial institutions with enterprise-grade capabilities

AI-POWERED INTELLIGENCE

Machine learning algorithms for predictive risk assessment, automated regulatory analysis, and intelligent workflow optimization.

Unified Platform

Single integrated solution eliminating data silos and providing a 360-degree view of governance, risk, and compliance operations.

Real-Time Monitoring

Continuous surveillance of transactions, fraud patterns, regulatory compliance, and risk indicators with instant alerting.

Regulatory Automation

Automated report generation, submission tracking, and regulatory update management reducing manual effort by up to 70%.

Scalable Architecture

Enterprise-grade infrastructure supporting multi-jurisdictional operations, unlimited users, and seamless integration with existing systems.

Security & Compliance

Bank-grade security with role-based access controls, comprehensive audit trails, and compliance with international data protection standards.

Proven Results

Our clients achieve measurable operational excellence

reduction in manual reporting effort

faster regulatory submission times

improvement in risk detection accuracy

increase in board and executive visibility

Why Choose GRC Sphere

Industry Expertise

Built by banking and risk management professionals with decades of combined experience in financial institutions, regulatory compliance, and enterprise software development.

Innovation-Driven

Continuous platform evolution with quarterly feature releases, incorporating the latest regulatory requirements, AI/ML capabilities, and industry best practices.

Partnership Approach

We view our clients as long-term partners, providing dedicated support, proactive guidance, and customization to ensure your GRC operations remain effective and efficient.

Proven Results

Our clients report 70% reduction in manual reporting effort, 85% faster regulatory submissions, 40% improved risk detection, and 90% increased board visibility.

Industries We Serve

GRC Sphere is purpose-built for financial institutions — delivering enterprise-grade governance, risk, and compliance automation across the financial services sector.

Frequently Asked Questions

Everything you need to know about GRC Sphere.

Give Your Board the Clarity They've Been Asking For

Contact us today for a personalized demonstration and discover how GRC Sphere can transform your compliance operations.